Latest insights

-

Public Affairs | 30 May 2025

Reflections from the World Health Assembly: policy, partnerships, and the power of the fringes

-

Transformation & Change | 09 May 2025

Internal communication in times of change

-

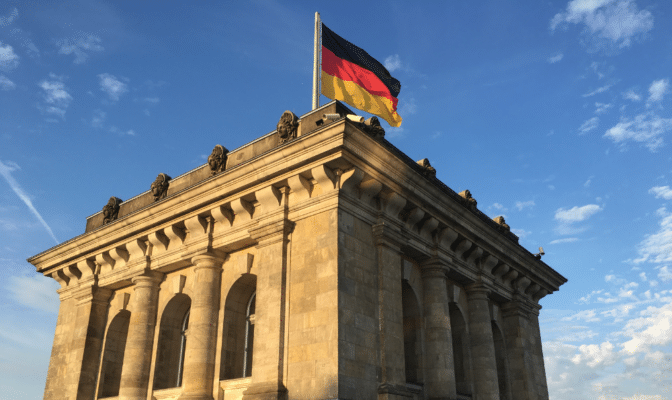

Policy Advisory & Strategic Services | 10 Apr 2025

Initial takeaways on the new German coalition agreement

-

Data, Digital & Creativity | 08 Apr 2025

Understanding value creation in the AI era

-

Policy Advisory & Strategic Services | 24 Mar 2025

How can business make sense of a world transformed?

-

Policy Advisory & Strategic Services | 11 Mar 2025

WHO's next? Trump's shake-up of the Global Health Agenda

-

Corporate Communications | 07 Feb 2025

Navigating the AI maze: echo chambers, fake news, and the race for regulation

-

Investor Relations & Financial Communications | 14 Jan 2025

2025: a return to form for private markets?

-

Data, Digital & Creativity | 09 Jan 2025

The evolution of influencer marketing